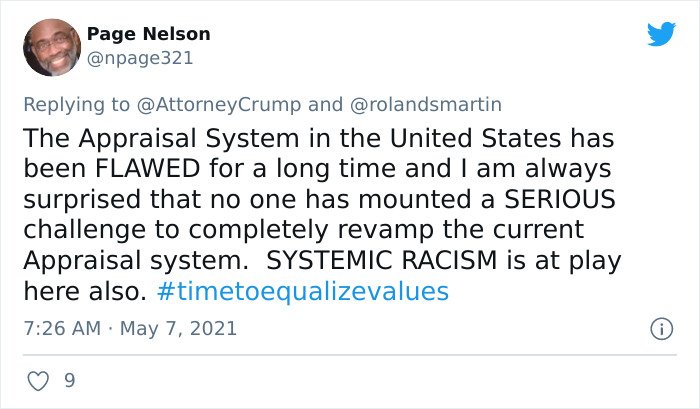

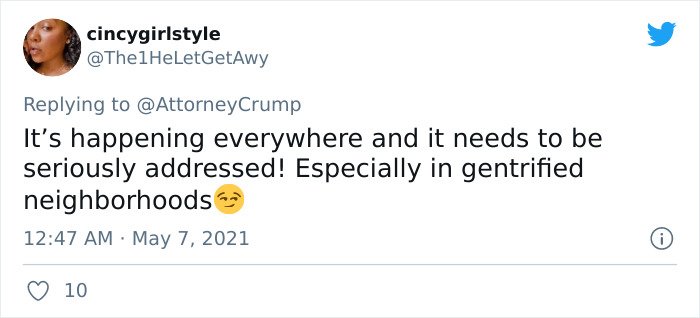

Living in the 21st century, we have all agreed that racism is merely a boneheaded theory because finally, we all know what matters is all humans being together despite the color, race, ethnicity etc. Right? Well, that’s what we all have been believing for decades until this black woman, Carlette Duffy from Indianapolis could get the appraisal over $100,000 for her house only by hiding her true identity. She had a white man seated in her house by the time company visited, and they believed that the house belonged to this man, which led to the approval of the appraisal.

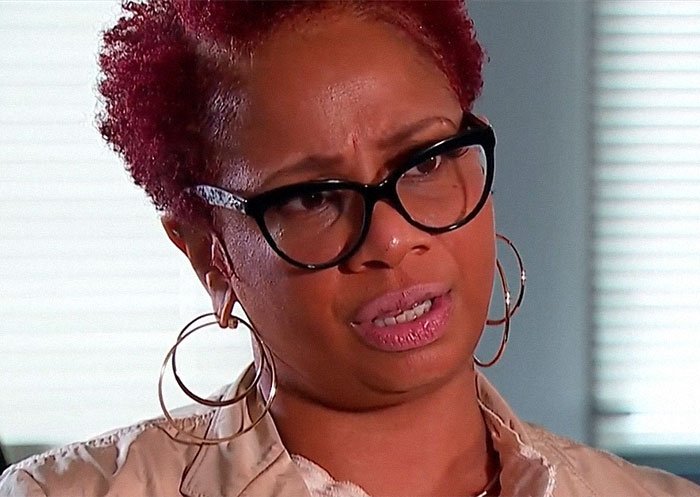

“I get choked up even thinking about it now because I was so excited and so happy, and then I was so angry that I had to go through all of that just to be treated fairly,” Carlette told Fox 50 News.

Living in a historically black neighborhood, Carlette wanted to refinance her house

Image credits: CBS4 Indy

Due to the housing boom last year, Carlette had an idea to sell her house and to buy her grandparents’ house nearby. Though she appraised the house twice, she couldn’t believe that she’s not earning any remarkable profit from it.

In 2017, she purchased the house for $100,000. She had to renovate the house completely after a fire and yet the value she got after the first appraisal was at $125,000 and $110,000 for the second time. “When I challenged it, it came back that the appraiser said they’re not changing it,” She further said.

Carlette wanted to use the equity from the refinance to buy her grandparents’ house.

Image credits: CBS4 Indy

In 2017, she purchased the house for $100,000. She had to renovate the house completely after a fire and yet the value she got after the first appraisal was at $125,000 and $110,000 for the second time.

Carlette came to know about a connection between home appraisals and racism when Executive Director Amy Nelson, from the Fair Housing Center of Central Indiana (FHCCI), talked to a community group. So Carlette decided to check whether there is a racism issue involved in her home appraisals by removing all her family photos and not by mentioning her identity on the new appraisal form. To convince the appraisal company, she even invited a white friend to be there when the company visits.

“I took down every photo of my family from my house. I took every piece of ethnic artwork out.” Duffy said. And BOOM! Her house value got increased by over $100,000. With this, Duffy also realized that the comparable houses the company determines have changed in the third time. The first two appraisals were determined by the houses in the same old black neighborhood, and the third one used the houses which were similar to hers.

Though she used the money to buy her grandparents’ house from the third appraisal, she didn’t step back to speak about this injustice. First, she filed a case in the Department of Housing and Urban Development (HUD) along with the aid of FHCCI, for discrimination.

“I’m doing this for my daughter and I’m doing this for my granddaughter, so that when they come against obstacles they will know that you can stand up, you can say that this is not right,” Duffy commented.

She applied for the third time, with a different approach

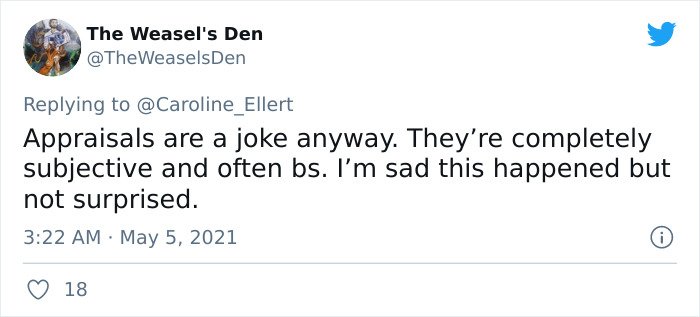

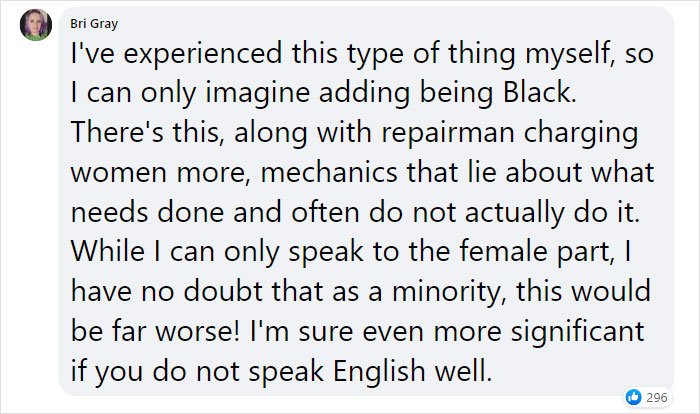

Though some of us still believe in equality, it seems like not everyone is on the same page. According to the New York Times, race and housing policies have been interconnected in NY for so long. Mainly the black community struggles hard to get house loans than the whites. And the specter of redlining (a discriminatory practice that denies mortgages for certain people in the neighborhood due to color and ethnicity) takes part in the black community.

Not only black owners, the mixed races, and even predominantly white neighborhoods say that their houses are not appraised as much as the white people’s though everyone blabs about building equality and income equality.

However, in legal terms, according to the Fair Housing Act of 1968, any discrimination against anyone based on color, ethnicity, race, religion, or gender could make the appraiser lose his/her license and even could lead to prison time.